This Florida city was hit hard when the housing bubble burst in 2008—now prices are falling again

[ad_1]

Looking for more real estate news from Lance Lambert ResiClubin your inbox? Sign up for ResiClub’s free, daily newsletter.

At the height of the housing boom in May 2022, FirstKey Homes, a realtor managed by private equity firm Cerberus, purchased a three-bedroom home at 25080 Estrada Circle in Punta Gorda, Florida for $445,000.

After putting it on the market for rent in July 2022, taking it off the market, and putting it back on the market at a lower rent, FirstKey Homes decided to sell the rental house for $400,000 in February 2024.

Fast forward to July 2024, and the home is still for sale right now, as its price dropped six times to $336,000. If it sells at that price, it will represent a 25% drop from its May 2022 purchase.

While the composite home price index is at an all-time high, some regional housing markets in states such as Florida, Texas, and Louisiana are experiencing home price corrections. This includes the Punta Gorda metro area in Southwest Florida.

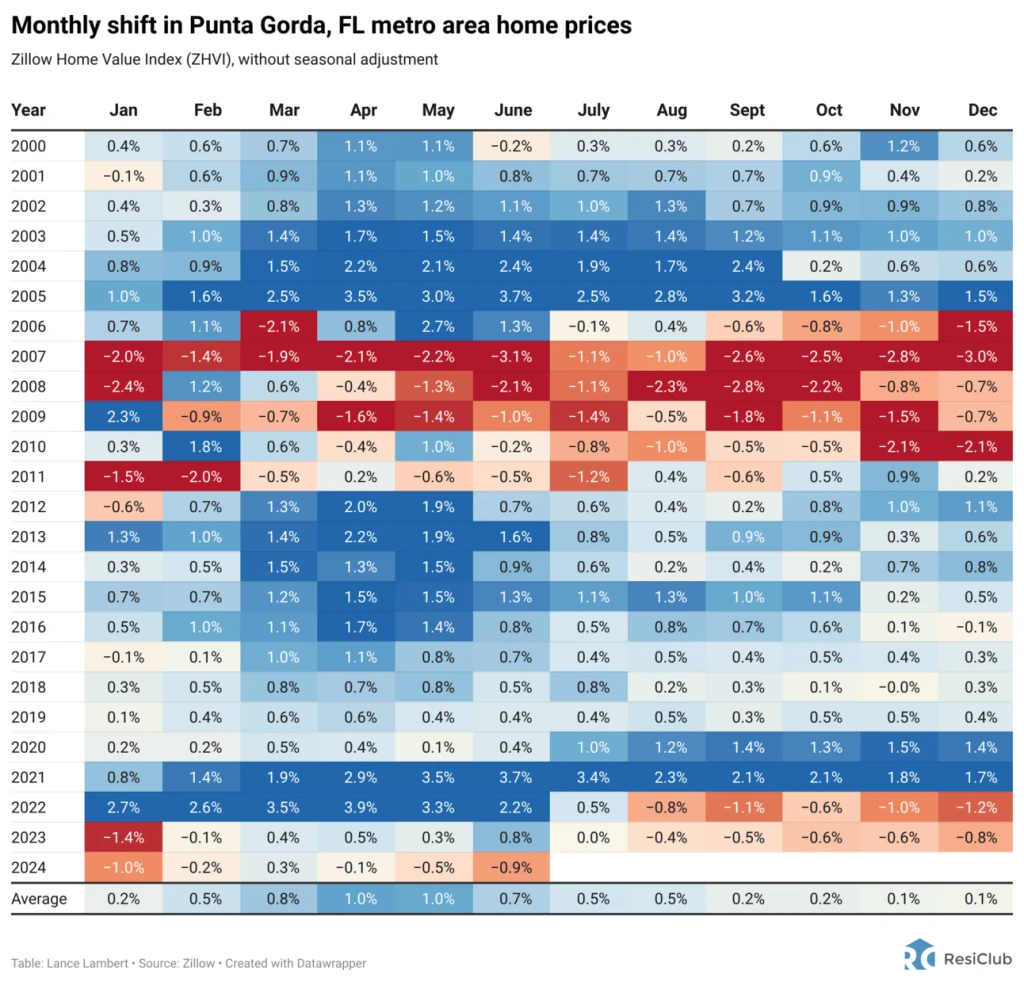

Click here to view the interaction of the chart below.

While the housing crisis was raging, it was particularly acute in Punta Gorda, which was hit by rapid retirements and out-migration.

Between December 2019 and July 2022, home prices in the US increased by 42.6%. During that same period, home prices rose 73.2% in Punta Gorda.

Not long after housing prices rose, and immigration changed, Punta Gorda got into it. ResiClub it calls “repair mode.”

This is not the first time Punta Gorda has gone through a home price correction.

Indeed, Punta Gorda was one of the hardest hit real estate markets during the 2008 housing bubble burst.

From peak to trough, US home prices fell 26.2% from the real estate bubble peak in 2006 to the bottom in 2012. In comparison, Punta Gorda home prices fell 47.8% from the high in 2006 to the low in 2011.

Home prices in Punta Gorda haven’t stopped falling yet, and are likely to drop again in the second half of 2024.

A sign that Punta Gorda saw very little home price appreciation during the spring season window. Historically, housing markets that see very little appreciation during the first half of the term, often see a drop in price when the market enters a seasonal soft window in the second half of the year.

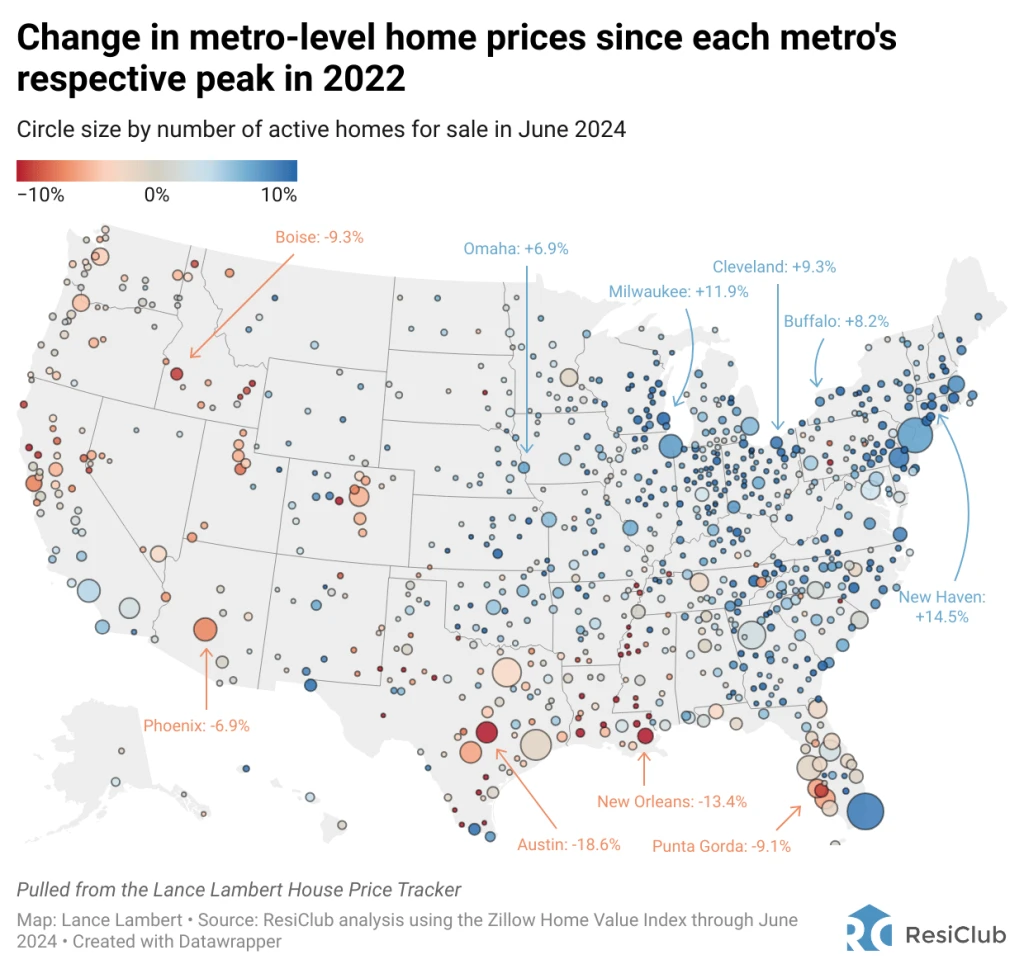

Most housing markets in the Midwest and Northeast and Southern California have higher home prices now than when mortgage rates begin to rise in mid-2022.

Not Punta Gorda.

Home prices in Punta Gorda are down 9.1% from the 2022 price peak. Only a few markets, such as Austin (-18.6%) and New Orleans (-13.4%), saw significant dips.

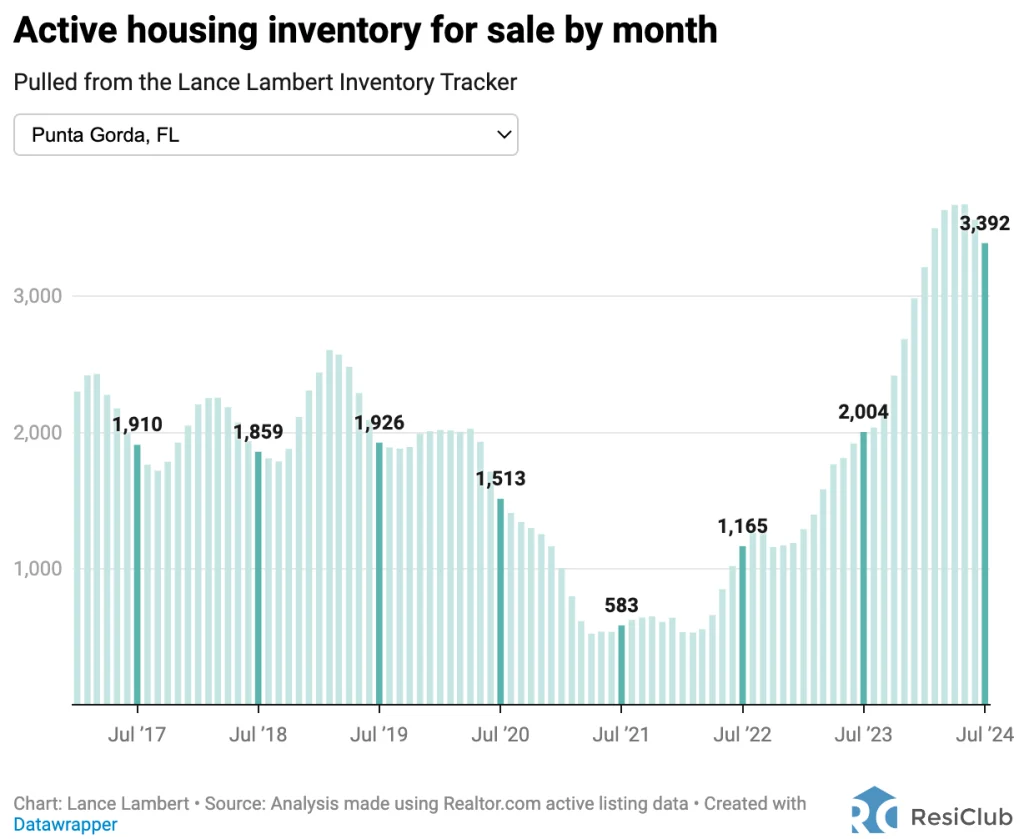

When assessing home price pressure, ResiClub believes it is important to monitor active listings and supply months. If active listings begin to increase rapidly, or rise significantly, as homes stay on the market longer, it may indicate potential price weakness in the future. Conversely, a rapid decline in active listings may suggest a growing market.

In Punta Gorda, active inventory has seen continued weakness since late 2022.

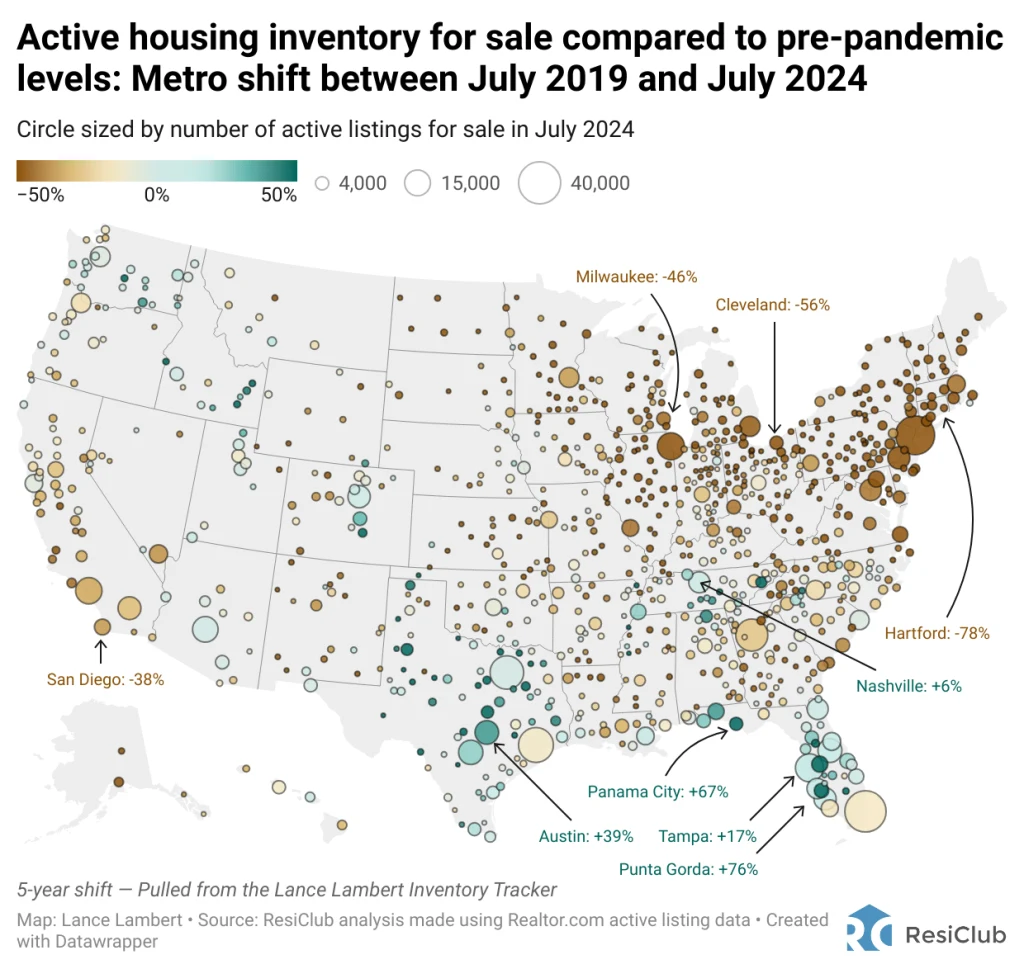

While US active inventory in July 2024 is still 29% below pre-pandemic levels in July 2019, Punta Gorda home construction is 76% above pre-pandemic levels.

Another factor that accelerated cooling in places like Punta Gorda, as well as Cape Coral and Fort Myers, was Hurricane Ian in September 2022. The combination of an increase in homes for sale (damaged homes) and severe demand—the result of a spiked home. prices, higher mortgage rates, higher insurance premiums, and higher HOA fees—translated into a softening of the market throughout Southwest Florida.

In addition, Florida’s condo market is affected by legislation passed following the Surfside condo collapse in 2021.

The biggest windfall in Punta Gorda’s real estate market, however, is the fundamentals.

Increased demand during the housing boom pushed Punta Gorda home prices significantly higher than the local currency. When rates rose and epidemic migration subsided, that depression became apparent.

According to Moody’s, Punta Gorda’s housing market in Q2 2022 was “overpriced” at 55.7%—well above the national average of 27% at that time.

Given the continued correction of Punta Gorda housing prices, and some income gains, its maximum valuation reached 28.3% in Q4 2023, according to Moody’s. However, that’s still higher than the 13.9% Moody’s average national rating for that quarter.

Despite having a much smaller population, the Punta Gorda metro area (206,134 residents) allowed more housing to be built during the housing crisis than many older Midwest and Northeast markets, including Pittsburgh (2.4 million residents).

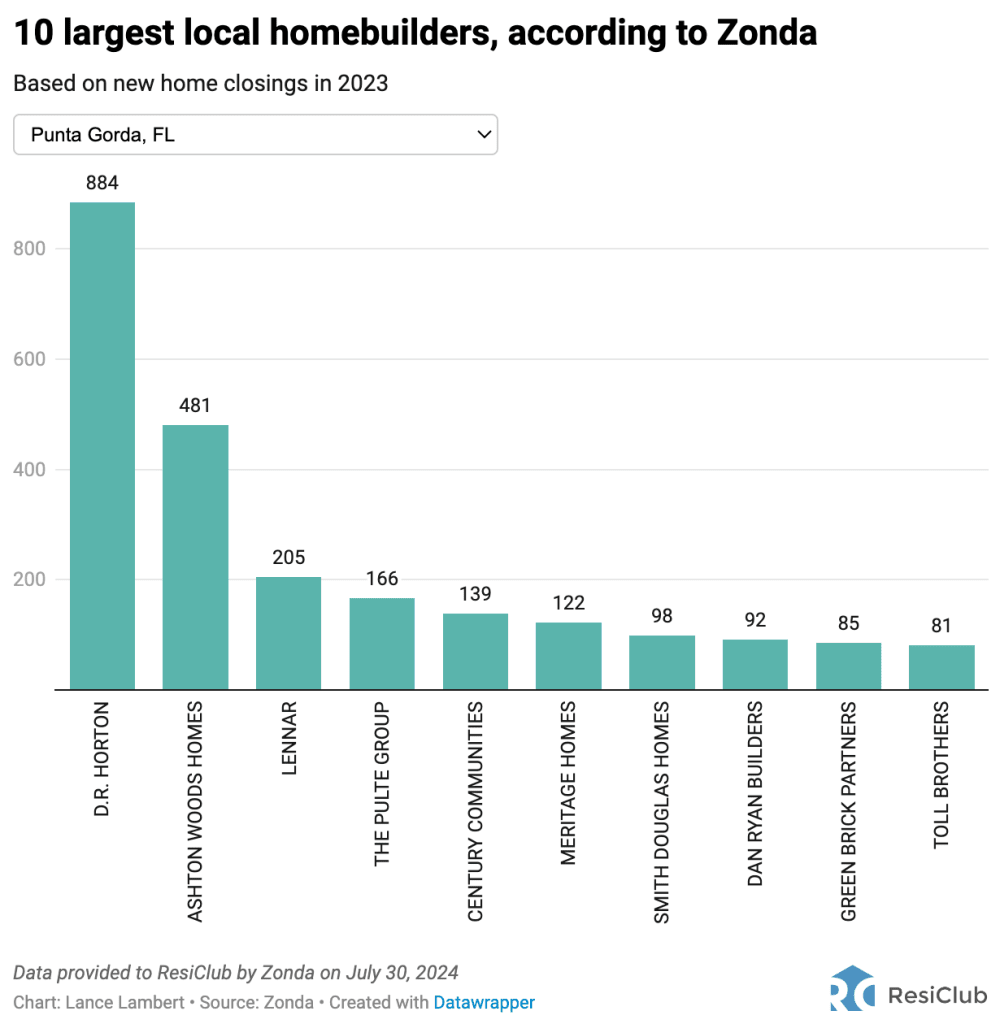

Although single-family home construction is not the main cause of Punta Gorda’s renovation, the influx of new construction in this troubled area, combined with builders making drastic affordability changes such as foreclosures or outright price reductions, is contributing to further weakening the resale market there.

Consider this: Why look for resale – since many real estate agents out there refuse to accept that prices have dropped by double digits – when major real estate developers, like DR Horton, are willing to pull out big deals in Punta Gorda? Therefore resale inventory lasts longer.

Main image: We are in the midst of a bifurcated housing market, where some of the hottest housing markets for the housing boom, like Punta Gorda, are going through a correction, while other markets, especially in the Northeast and Midwest, remain strong and competitive. . And some markets are somewhere in between.

[ad_2]

Source link