RHOC’s Vicki Gunvalson Sued By Former Client For Financial Elder Abuse

[ad_1]

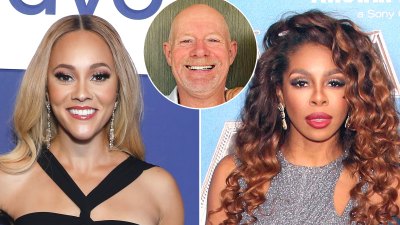

Vicki Gunvalson

Rich Polk/BravoVicki Gunvalson is being sued by a former client of his insurance company for financial elder abuse, negligence and fraud, among other allegations.

Diane Field74 years old, filed a lawsuit against Gunvalson and his business partner Ali Hashemian in California Superior Court in Orange County in late May, according to court documents obtained by Us Weekly Wednesday, July 31.

Field said she and her late husband, George, had an estimated net worth of $6 million, and was able to manage their finances after being “severely injured in a bicycle accident” in 2002. That same year, Field’s mother died and left an inheritance. Field transferred the funds to an Allianz 222 annuity, a savings plan that helps reduce personal taxes. “Diane has always left money in this account (she has never been contacted) for the purpose of raising her daughter,” he said in his file.

Field recalled meeting Gunvalson, 62, in 2019, when he went to a dinner hosted by. The Real Housewives of Orange County alum and his company, Coto Insurance & Financial Services. According to Field, Gunvalson told him at the time “that he could help him manage his finances.” Field said he later met with Gunvalson and Hashemian, who promised him that “if he invests his money in them, he will have lower income taxes and increase the future/potential income of his children.”

When George’s health worsened, Diane hired a live-in caregiver. “When I look back, [she] “He thinks that the grief and trauma he endured during this time contributed to him allowing himself to put his trust in Gunvalson and Hashemian as they seemed to be sincere and seemed to be working for Diane’s best interests,” the file said.

Field alleges that the pair forced him to invest in life insurance without explaining “how much it would cost.” He said Hashemian had said he had to make a “one-and-done” payment of $300,000 to cover the $6 million that would be paid to his family after his death.

In retrospect, “Diane realizes that this was intentional, misleading, and false. “Instead, it was a good time for Hashemian to tell her that she would need to pay $300,000 a year for the policy, which he did not tell Diane,” the suit states.

Field entered into the contract in December 2019 “relying on Gunvalson’s “sham sales tactics” and while feeling “desperate” due to George’s declining health. In 2020, he was diagnosed with lung cancer and underwent surgery to cure it. A few weeks after his surgery, he paid another $300,000 on his life insurance.

“Although he thought he should have made this $300,000 payment once he opened the policy based on what Hashemian had promised him, his hands were tied, and he made the payment again because he felt he had no choice,” the legal documents claimed.

George died in October 2021, and Field said afterward, Gunvalson and Hashemian persuaded him to put George’s money into a private retirement account. The following year, “she began to wonder why she was paying the $300,000 again, since it was not what Hashemian had promised her, but she continued to do it anyway, since her husband had just died and she was still crying. his loss (and he was recovering from hip surgery).

In December 2022, Field said he emailed Gunvalson and Hashemian, writing that he “felt ignorant about them and that the annuity and life insurance they convinced him to open seemed like the best investment to him, as they combined large sums of money that he would not be able to use for a long time, maybe a while.” longer than the one he will live even if he is too old to enjoy it.”

In March 2023, Gunvalson offered Field an option to reduce his life insurance premium to $100,000 per year, and Field took the deal and “sold some of his stock” to make that $100K down payment. At that time, his death benefit was reduced to $3.5 million.

When Field was due to pay the next $100K in the spring of 2024, Gunvalson “contacted Diane repeatedly to remind her.” Instead, Field bypassed Gunvalson and “contacted Allianz directly in April 2024 to see what the due date was, and the representative at Allianz told Diane that she had $600,000 in her account as she was previously paying $300,000 a year in premiums. Diane was told that she should not send any payment at all because of this charge on her account.”

In conclusion, Field’s lawsuit stated, “Defendants planned and engaged in a pattern of financial abuse of the elderly through cruelty, oppression, and fraud.”

Us Weekly has reached out to Gunvalson, Hashemian and Coto Insurance for comment.

It wasn’t the first time one of Gunvalson’s former clients sued him. Joan Lee, then 82, accused the reality star in 2019 of raising premium costs. That case was dismissed with prejudice.

Gunvalson’s former costar, Teddy Mellencampappears to have responded to the lawsuit on Tuesday, July 30, writing in X, “I HAVE NEVER HURTED MANY ELDERLY IN MY LIFE. RHOC fans will know that Mellencamp, 43, has been playing the iconic Gunvalson line since season 8 of the series. That line: “I’ve never had more partners in my life!”

[ad_2]

Source link