Housing affordability has been crushed. Kamala Harris just launched a show that will make it worse

[ad_1]

Looking for more real estate news from Lance Lambert ResiClub in your inbox? Register on ResiClub for free, every day newspaper.

During the Pandemic Housing Boom, demand for housing increased rapidly amid extremely low interest rates, stimulus, and prolonged job growth. Federal Reserve investigators estimate that “new construction would have had to increase by nearly 300% to accommodate the surge in demand during the pandemic.” Unlike the demand for housing, the supply of housing is inelastic and cannot increase rapidly. As a result, rising demand overwhelmed the active inventory market, causing prices to overheat, with US home prices in May 2024 a staggering 50.3% above March 2020 levels.

That wildly inflated home price growth—combined with a mortgage rate shock, with the 30-year fixed-rate mortgage rate rising from a record low of 2.65% in January 2021 to 6.49% as of this week—has created a rapid-on-going deterioration in housing affordability.

On Friday, Vice President Kamala Harris unveiled her plan to address housing affordability and spur the construction of 3 million additional homes during her first term as president, including:

- Government assistance for first-time homebuyers: The Harris campaign says its plan will allow “more than 4 million first-time buyers over four years to receive significant down payment assistance averaging $25,000.”

- Creating a tax to encourage builders to build starter homes: “Would go hand in hand” with the Neighborhood Housing Tax Credit, the Harris campaign says.

- Extension of existing tax incentives for “developers of affordable rental housing”

- Creating a $40 billion innovation fund that “will empower local governments to fund housing solutions”

The problem with Harris?

As the country experienced firsthand during the Pandemic Housing Boom, the demand for housing can jump quickly, but the total housing stock cannot respond quickly. So while we can imagine that Harris’ plan would increase new construction to some extent, it would be a gradual increase that would take years to implement. Meanwhile, the increase in housing demand from the $25,000 down payment assistance will be felt immediately once it goes into effect.

Giving millions of first-time homebuyers $25,000 in down payment assistance could quickly increase demand for housing, accelerate home price appreciation, and further depress housing costs, especially in the Midwest, Northeast, and California housing markets where the supply of active homes for sale remains at a very low pre-buy rate. houses. epidemic levels.

On the supply side, many housing analysts agree with Harris that the US housing market needs more homes.

“Over the past few years, our research on the housing shortage has been widely followed, and while we’ve seen housing starts slowly improve, the shortage remains and remains one of the most important obstacles facing the housing market today,” Len Kiefer, Freddie Mac’s deputy chief economist, told ResiClub in May.

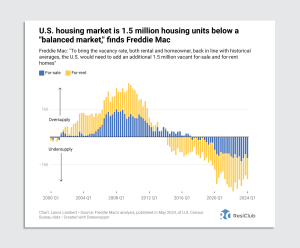

Just to return housing vacancy rates to historic values, the US housing market would need 1.5 million homes built and sitting empty, according to a study published by economist Freddie Mac in May.

So even with strict accounting, Freddie Mac economists estimate that the US housing market is 1.5 million homes short. The real housing shortage, Freddie Mac tells ResiClub, is about 3.8 million units.

This presents another problem for Harris: Not only will the money supply not accelerate housing demand faster than housing construction, but the realities of supply capacity will be a significant roadblock to his goal of adding 3 million additional homes beyond the current trajectory when he wants it. four years.

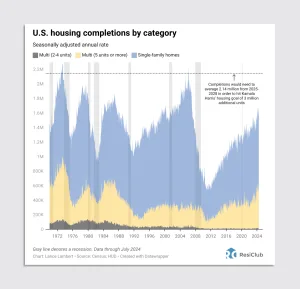

As of January 2020, the US has completed an average of 1.39 million homes per year. To achieve an additional 3 million homes beyond the current approach, annual housing construction would need to increase by 750,000, to 2.14 million beginning in 2025, 2026, 2027, and 2028.

Such an increase in residential construction over such a short period of time, outside of the post-recession recovery, is unprecedented. Housing construction involves a large number of materials from around the world—such as lumber, windows, and concrete—making it challenging to achieve even incremental construction volume. During the Pandemic Housing Boom, builders tried to quickly increase capacity to meet the high demand for housing. However, they were only able to reach 1.82 million annual homes starting in April 2022 before they hit supply limits and faced soaring input prices, including lumber, which at one point rose more than 300%.

What can the US do to improve housing affordability? First, just take your time and make smart financial and financial decisions. If you do it right, over time incomes rise and mortgage rates fall, helping to alleviate the historic housing affordability crisis caused by an epidemic of housing demand and subsequent rate shocks. Second, focus on policies that increase housing construction and supply capacity—perhaps some of Harris’ current ideas—but without causing a sharp acceleration in demand.

One final point: The unfortunate truth is that improving housing affordability may not be as easy or straightforward as some think. But like a Lego building, sometimes it’s easier to identify what might break it (housing, increasing consumer demand) than to fix it.

[ad_2]

Source link